Join eToro broker to experience the most favorable social trading environment

10 min read

ETORO BROKER REVIEW

Content on this page is intended for information and educational purposes only and should not be considered as an investment advice or investment recommendation.

10 August 2021

Zaine Allen

CFD trading is gaining momentum and there is an obvious reason for it. A contract for difference allows you to trade not the asset itself, but only its price. CFDs will allow speculation on price movements (up or down), while the investor gets all the benefits that are associated with trading assets without actually having them. In other words, CFD trading is affordable to individuals. The only task is to find a reliable broker. And here is an eToro review, one of the world's most trustworthy CFD platforms.

About broker

eToro is one of the largest CFDs and Forex brokers in the world. The company has been operating in the industry since 2007. In addition to the main office located in Cyprus, the broker has representative offices and sales offices in many countries around the world.

In 2009, eToro opened the WebTrader platform and in 2010 its famous OpenBook platform was launched. Available assets include precious metals, commodities, currency pairs, global indices and major corporate stocks. Since 2014, customers can trade digital currencies. Bitcoin is available as a CFD derivative. Traders can buy and sell cryptocurrencies, the value of which is determined on the open market.

In 2009, eToro opened the WebTrader platform and in 2010 its famous OpenBook platform was launched. Available assets include precious metals, commodities, currency pairs, global indices and major corporate stocks. Since 2014, customers can trade digital currencies. Bitcoin is available as a CFD derivative. Traders can buy and sell cryptocurrencies, the value of which is determined on the open market.

Trading conditions are transparent and comfortable and include low fixed spreads starting at 1.3 pips on major currency pairs, maximum leverage reaching 400: 1 and eToro minimum deposit of $50. The broker offers a free demo account to all its clients. Also, there is round-the-clock technical support available in several languages.

The main feature of the eToro broker is its largest social trading platform OpenBook. Actually, eToro is a Forex expert and social trading guru. Its trading platform is especially attractive for beginners mainly because of social trading. It enables newcomers to copy the trades of professional investors and make money on it. Social eToro trading is a new format of investment services that successfully combines the ability to attract customers through social media mechanisms and the traditional approach to working in the financial markets. The broker received a number of awards for its services.

The main feature of the eToro broker is its largest social trading platform OpenBook. Actually, eToro is a Forex expert and social trading guru. Its trading platform is especially attractive for beginners mainly because of social trading. It enables newcomers to copy the trades of professional investors and make money on it. Social eToro trading is a new format of investment services that successfully combines the ability to attract customers through social media mechanisms and the traditional approach to working in the financial markets. The broker received a number of awards for its services.

Regulation

It is the first and foremost task of a trader to check if the selected brokerage company is legitimate. Trading platform will become your partner that will get access to your funds. So it is time to ask – is eToro safe?

eToro is a trusted and reliable broker with multiple licenses from reputable regulators. EToro operates via three subsidiaries that work in different countries and territories:

eToro is a trusted and reliable broker with multiple licenses from reputable regulators. EToro operates via three subsidiaries that work in different countries and territories:

eToro (UK) LTD operates in the UK. Registration number is 7973792

eToro (UK) LTD operates in the UK. Registration number is 7973792 eToro (Europe) LTD is registered in Cyprus and provides services in the countries of the European Community. Registration number is HE20058

eToro (Europe) LTD is registered in Cyprus and provides services in the countries of the European Community. Registration number is HE20058 eToro AUS Capital Pty LTD offers services to Australian clients. The registration number of the legal entity is ABN 66 612 791 803

eToro AUS Capital Pty LTD offers services to Australian clients. The registration number of the legal entity is ABN 66 612 791 803

eToro (UK) LTD operates in the UK. Registration number is 7973792

eToro (UK) LTD operates in the UK. Registration number is 7973792 eToro (Europe) LTD is registered in Cyprus and provides services in the countries of the European Community. Registration number is HE20058

eToro (Europe) LTD is registered in Cyprus and provides services in the countries of the European Community. Registration number is HE20058 eToro AUS Capital Pty LTD offers services to Australian clients. The registration number of the legal entity is ABN 66 612 791 803

eToro AUS Capital Pty LTD offers services to Australian clients. The registration number of the legal entity is ABN 66 612 791 803

All companies operating under the eToro brand are interconnected and work according to the same rules.

Getting started

During the initial registration on the eToro website you must provide your name, email address, phone number. After this, the service offers to answer a few questions. You will need to provide further information about your experience in trading, the level of knowledge in this area, the goal of future earnings, the expectations from investments. The broker also asks you to indicate the source of income and the level of net annual income. Finally, you will have to upload a copy of your identity document – you can use a copy of the passport.

Account types

DEMO

eToro demo account

The broker supports new traders by allowing them to test their strengths on a demo account. Every holder of this training account gets access to the virtual capital in the amount of $100,000. eToro demo account becomes available right after the registration. After filling out the appropriate form on the site, you are free to choose a real or virtual account. This account is completely risk-free, which means you can use it to test new strategies and techniques without risking losing your hard earned money.

REAL

A real trading account

This account allows traders to use real money in their trading. You can activate this account by depositing $200 (residents of the USA and Australia can deposit only $50. The broker encourages traders to deposit large sums by its eToro club program. Based on your deposit amount, you will get a special status which offers additional privileges.

Status/details

Silver

Gold

Platinum

Platinum+

Minimum deposit

$5,000

$10,000

$25,000

$50,000

Personal manager

✗

✓

✗

✗

eToro crypto staking

85%

85%

85%

90%

Credit line

✗

✓

✗

✗

Exclusive analytics

✗

✓

Diamond

$250,000

✗

90%

✗

No withdrawal commissions

✗

✗

✓

✓

Invitation to major financial events

✗

✗

✗

✓

Annual VIP meeting

✗

✗

✓

✓

✓

✗

–

–

–

✗

Note that all live meetings are currently restricted due to COVID-19 pandemic.

Additional services and incentives

In general, the broker has a good selection of trading assets, but there are some nuances. On the company's platform, you can work on the Forex market through CFD derivatives. Spot stocks, ETFs and cryptocurrencies are also available here. In addition, the broker has several very useful features for passive trading, such as:

- copying trading strategies;

- the ability to promote your own fund (CopyPortfolio function).

Long positions to buy stocks, ETFs and cryptocurrencies are opened using real trading assets. For short positions, CFD derivatives and leverage are used.

- eToro offers shares from 17 stock exchanges around the world, including Nasdaq, London, and Hong Kong. You may think that this is a lot, but in fact, not all shares of these exchanges are available for trading. It usually only includes the most popular stocks like Apple or Tesla. However, smaller companies are not included. For example, you can only trade 10% of the total of all available companies on the Nasdaq exchange on eToro. It's the same with other exchanges on the platform..

- eToro also offers a collection of stock market indices on the platform. At the moment there are more than 10 of them, such as the dollar index and the S&P 500 index, which includes 500 large companies publicly listed on the Nasdaq and New York stock exchanges.

- This instrument is also available on eToro. There are 83 ETF options on the platform right now, and each one is tiled to make it easier to decide which one you want to trade. Many of these tiles also contain additional information to help traders in the future.

- eToro also offers to invest in gold, silver, copper, platinum, palladium, cocoa, oil and many more.

- There are nearly 2000 CFD trading options on the platform.

- eToro was one of the first CFD brokers to begin allowing crypto CFD trading. In 2014, traders could access eToro bitcoin transactions, and in 2017, a list of other digital coins was added.

eToro Popular Investor program

The broker allows you to get a profit not only via trading. You can get copied and paid for this. There is a special Popular Investor program that is open for every trader of the platform. The program has four tiers Cadet, Champion, Elite and Elite Pro. Depending on which program you choose, you can enjoy all sorts of special perks and privileges, from monthly payments to discounts and management fees.

Platforms

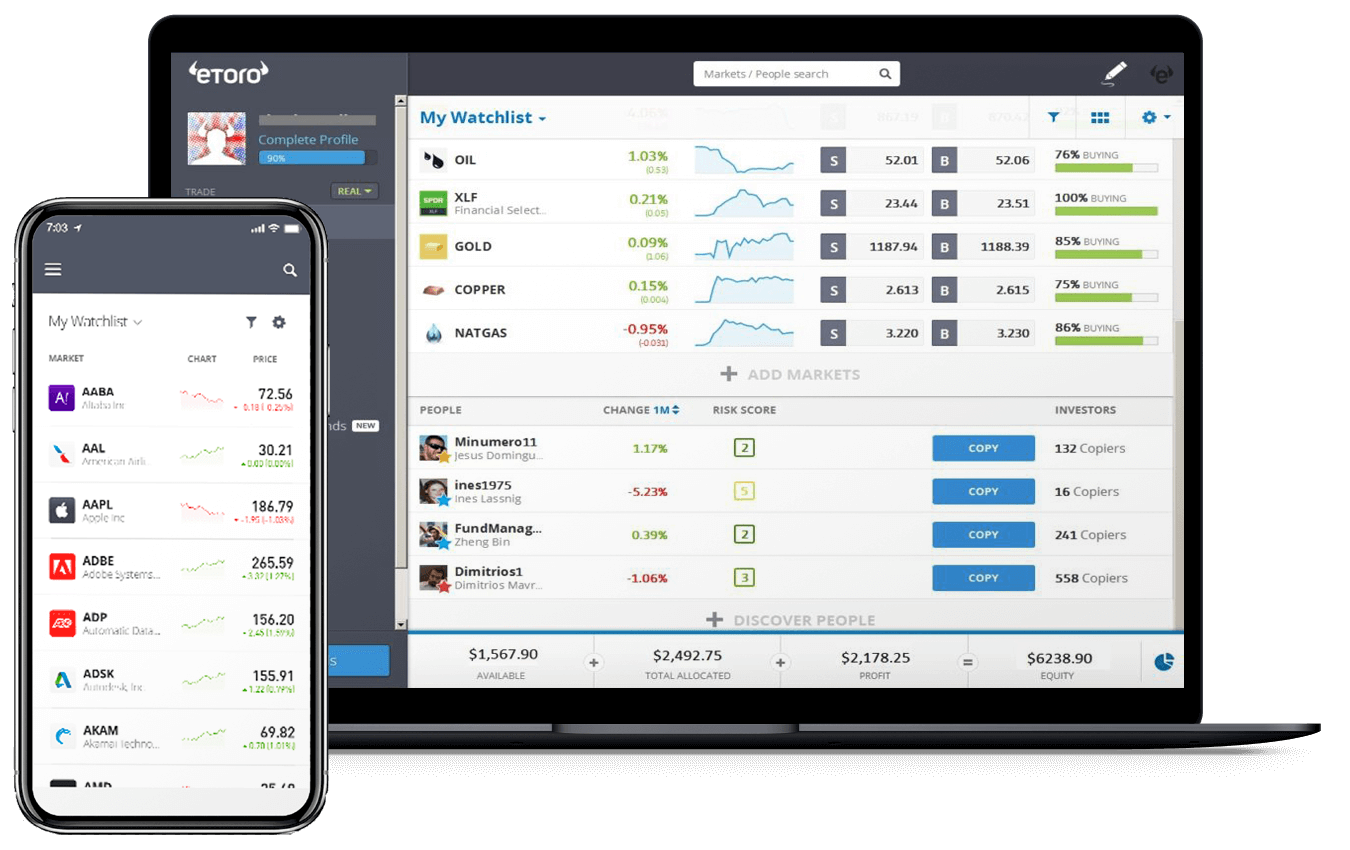

There are currently three trading platforms on eToro: eToro Webtrader, eToro Openbook, and eToro Mobile Trading.

Almost any Forex broker has such a platform, but eToro's terminal is distinguished by the presence of a chat that allows traders to correspond in real time. If the trader does not want to communicate with anyone, he can make his status invisible.

The interface of the Webtrader platform is very simple, it includes only the most necessary information for making deals. Since this is a web-based platform, you can access it from anywhere in the world where there is an Internet connection.

More

The interface of the Webtrader platform is very simple, it includes only the most necessary information for making deals. Since this is a web-based platform, you can access it from anywhere in the world where there is an Internet connection.

More

OpenBook is a kind of Facebook Forex trading. On this platform, you can see what other traders are doing in real time. This way you can find the most appropriate strategy or try out new strategies.

The similarity of the OpenBook platform with the social network allows, in particular, to learn how to trade much faster. Finally, traders trading with the OpenBook do not need to perform complex analysis and search for strategies on their own - financial market experts will do everything that is required for successful trading.

More

The similarity of the OpenBook platform with the social network allows, in particular, to learn how to trade much faster. Finally, traders trading with the OpenBook do not need to perform complex analysis and search for strategies on their own - financial market experts will do everything that is required for successful trading.

More

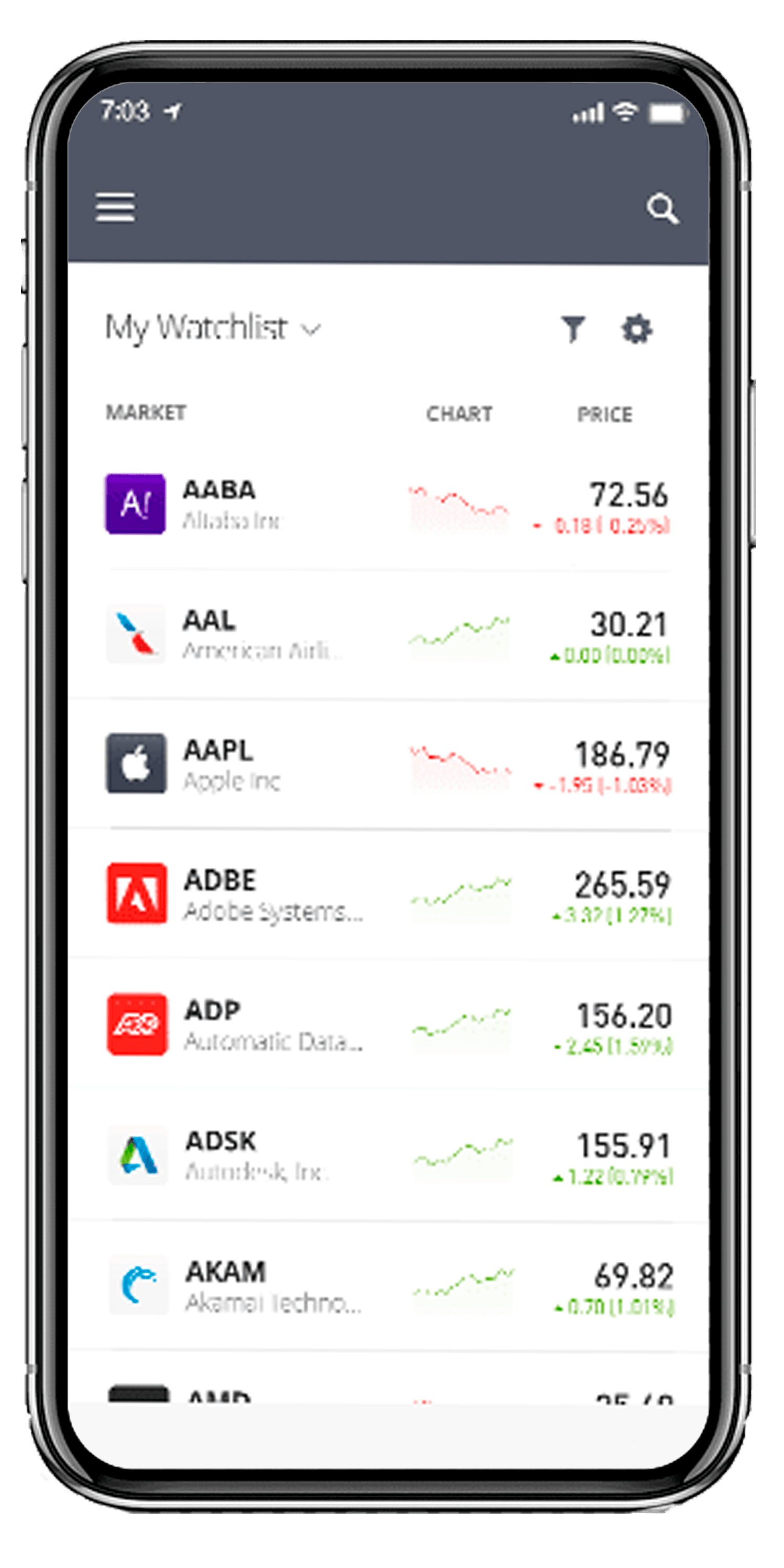

In the modern world, mobile technologies have penetrated all spheres of our lives, including Forex trading. Using smartphones and tablets, traders tend to follow the market from any location.

With this in mind, the developers of the eToro platform have created a special eToro app, allowing users to access Webtrader and OpenBook via mobile devices. With the help of such applications, you can always find a profitable opportunity in the market, even if you are very far from your computer.

More

With this in mind, the developers of the eToro platform have created a special eToro app, allowing users to access Webtrader and OpenBook via mobile devices. With the help of such applications, you can always find a profitable opportunity in the market, even if you are very far from your computer.

More

Payments and commissions

Once you are ready to start real trading on the platform, you will have to start with depositing $100 to your account. To make this operation possible for everyone, the broker supports several payment methods:

- Neteller

Banking cards

Banking cards- Skrill

- Bank transfer

- PayPal

Other electronic systems

Other electronic systems

All deposit transactions are fee-free, but withdrawals cost $5 per transaction. This is definitely a high rate compared to other brokers. In addition to this, eToro also sets a minimum withdrawal limit, depending on your account type and country of residence. You should check this information in advance.

You can withdraw money in the same way as you have deposited it. Your ID must also match for the withdrawal to be authorized. If there is a mismatch, your transaction will not be approved.

eToro takes a commission for providing services. It is average for the broker in the market. More details on spreads below:

You can withdraw money in the same way as you have deposited it. Your ID must also match for the withdrawal to be authorized. If there is a mismatch, your transaction will not be approved.

eToro takes a commission for providing services. It is average for the broker in the market. More details on spreads below:

- cryptocurrencies - from 0.75%;

- commodities - from 2 to 45 points;

- Forex - from 1.5 pips on secondary pairs, and 1-2 pips on major pairs;

- Stocks and ETF - from 0.75%;

- indices - from 75 points

Etoro also charges a fee for inactive accounts. If the user has made a deposit with real money, but has not visited the personal account for more than a year, the broker will charge a fee of $10 for each month. This fee is charged only from real trading accounts.

Training and analytics

The broker has an educational portal - Trading Academy, but it is not very big. You will find only three basic categories of materials:

- Webinars

- Videos with instructions

- An introductory course for beginners with a guide to trading

From analytical point of view, eToro traders have at their disposal:

- a large number of technical indicators;

- various tools for technical analysis;

- several types of price charts, moreover, you can change the entire style of the terminal (light and dark);

- various timeframe options;

- you can follow economic news right in the terminal;

- communication with colleagues is available (for example, you can discuss the current market situation with other traders).

Сustomer support

eToro is an international company, so it provides customer support in a variety of languages. Communication with eToro operators is possible through several channels in a 24/5 format:

- You can use a feedback form on the broker's website;

- You can reach the support team on social networks Facebook, Instagram and Twitter.

According to eToro's reviews you are not likely to receive a response by return to your query. Sometimes, it will take up to 14 days to get a solution to your issue.

Conclusion

- Multi-asset platform with 2000+ instruments

- Suitable for both new and expert traders

- Attractive social trading platform

- Various loyalty programs

- Insufficient customer support

- Withdrawal commission

Summing up, the eToro is a great solution for beginners who are looking for more experience in the Forex industry or CFD and crypto trading. There is also no eToro alternative in view of social trading – traders with little time for research have enough opportunities to earn on the OpenBook platform. The broker offers nearly 2000 trading instruments, but it is important to take into account spreads that are being applied for each of them. Overall, eToro is a reliable trading platform, the activities of which are controlled by the relevant supervising authorities. Millions of traders are successfully earning here, and you can become one of them.

GENERAL RISK WARNING:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

87% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

87% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.