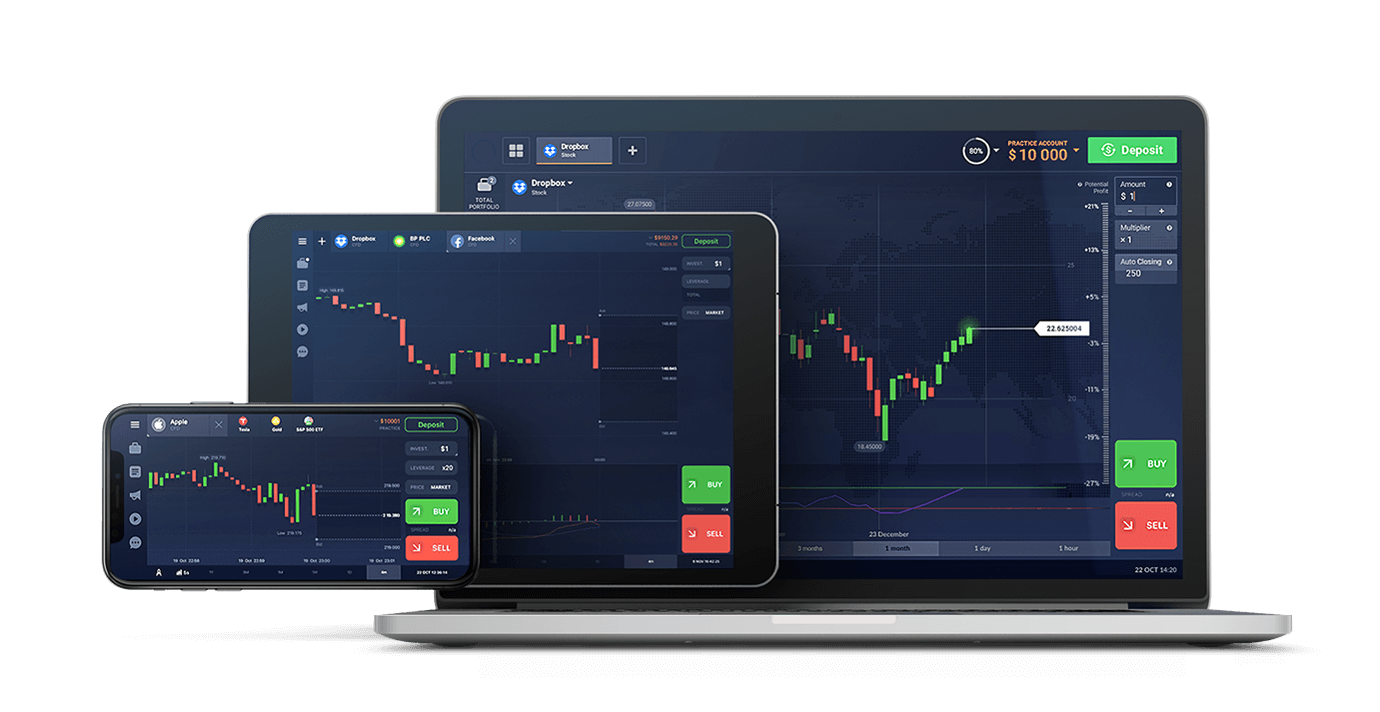

Cross Platform App for Online Trading

Online trading is a trading instrument with a possible high return. But it is also a risky instrument, because trader can loose investing funds in case of wrong prediction. Also, the convenience of the platform has a big impact on it. In this article we review on of the most suitable platforms fo Online Trading.

This website may contain affiliate links. That means if you visit broker via such link, register and make a deposit, we may receive a small commission at no extra cost to you.

Top Brokers

★

Top Online Trading Brokers in India 2023

MIN. DEPOSIT

FREE DEMO

LEVERAGE

BONUSES

FOUNDED

$10

Yes

Unlimited

No

2008

WEBSITE

Broker rating:

GREAT CONDITIONS

MIN. DEPOSIT

FREE DEMO

LEVERAGE

BONUSES

FOUNDED

$200 - $50

Yes

1:30 - 1:400

No

2000

WEBSITE

Broker rating:

FOR EXPERIENCED

MIN. DEPOSIT

FREE DEMO

LEVERAGE

BONUSES

FOUNDED

$100

Yes

1:500

No

2000

WEBSITE

Broker rating:

FOR EXPERIENCED

MIN. DEPOSIT

FREE DEMO

LEVERAGE

BONUSES

FOUNDED

$100

Yes

1:300

Yes

2000

WEBSITE

FOR EXPERIENCED

Broker rating:

MIN. DEPOSIT

FREE DEMO

LEVERAGE

BONUSES

FOUNDED

Not limited

No

1:40

For referral

1996

WEBSITE

Full review

Broker rating:

FOR EXPERIENCED

MIN. DEPOSIT

FREE DEMO

LEVERAGE

BONUSES

FOUNDED

Not limited

Yes

1:5

Yes

2010

WEBSITE

Full review

Broker rating:

FOR EXPERIENCED

MIN. DEPOSIT

FREE DEMO

LEVERAGE

BONUSES

FOUNDED

Not limited

-

Up to 1:7.5

Yes

2017

WEBSITE

Full review

Broker rating:

Best for Beginners

About Online Trading

Is Online Trading legal in India?

According to local law, trading on the exchange, including Forex and Online Trading, is legal. An Indian trader has the right to make a profit and withdraw money by paying the necessary taxes.

How can I learn trading Online Trading before investing real money?

Broker creates the best conditions for making money on Online Trading. For example, an Indian trader can minimize risks by opening a demo account. This option is available to all registered customers. After activating it, you get 10,000 virtual dollars in the account. This money can be used for transactions on Online Trading, and real indicators are taken into account here. Of course, this method will not bring real profit, but the Indian client will be able to learn about all the nuances of trading, choose the best strategy and develop tactics without losing real money.

Besides, we recommend visiting the information section. It contains information on trading news, an analysis of modern strategies (taking into account the advantages and disadvantages), as well as tips from successful users. Learn from the mistakes of others to make your path to success more effective. The link is at the bottom of the site.

Besides, we recommend visiting the information section. It contains information on trading news, an analysis of modern strategies (taking into account the advantages and disadvantages), as well as tips from successful users. Learn from the mistakes of others to make your path to success more effective. The link is at the bottom of the site.

What amount to invest?

One of the most important qualities of a professional trader is money-management. The ability to properly manage money allows you to minimize losses and increase profits from Online Trading. Remember that the minimum deposit amount is $10, and the transaction amount is $1. There are no 100% effective strategies in trading, so invest only the amount of money that you can afford to lose. There are also some tips from professional users:

- The maximum transaction amount should not exceed 10% of the bank. This method allows you to reduce potential losses — professionals do not put all the money on one horse. Even if the probability of the forecast is very high, something may go wrong. Therefore, it is better to earn less, but eliminate the risk of losing everything;

- Do not succumb to the excitement. The desire to quickly recover losses can lead to bankruptcy. You must understand that even unsuccessful transactions are a positive result — they provide an opportunity to analyze factors, draw conclusions and improve the strategy.

What tools do you use while working with Online Trading?

The basic principle of successful Online Trading is a correct forecast of price changes for selected assets. For this, it is necessary to conduct a comprehensive analysis and pay attention to a large number of parameters.

Technical analysis is a basic and very important stage of analysis since it allows you to determine the type of current trend — ascending or descending. To identify the type of trend and its long-term, financial analysts use many tools, such as basic figures of technical analysis or various indicators.

Another basic concept of technical analysis is volatility, which shows the degree of price volatility, that is, how much the value of an asset rushes from one side to the other. The greater the volatility, the more unstable the price movements will be, the more zigzags will appear on the chart. Conversely, the lower the volatility of the asset, the more stable the price of the asset.

Interactive price charts provide the ability to visualize indicators — just click on the Indicators button and select the desired indicator from the list that appears. The basis of any indicator is a trend and some other more subtle algorithms which allows you to fairly accurately predict the future price trend in the short term. The most commonly used indicators in the technical analysis should include:

Technical analysis is a basic and very important stage of analysis since it allows you to determine the type of current trend — ascending or descending. To identify the type of trend and its long-term, financial analysts use many tools, such as basic figures of technical analysis or various indicators.

Another basic concept of technical analysis is volatility, which shows the degree of price volatility, that is, how much the value of an asset rushes from one side to the other. The greater the volatility, the more unstable the price movements will be, the more zigzags will appear on the chart. Conversely, the lower the volatility of the asset, the more stable the price of the asset.

Interactive price charts provide the ability to visualize indicators — just click on the Indicators button and select the desired indicator from the list that appears. The basis of any indicator is a trend and some other more subtle algorithms which allows you to fairly accurately predict the future price trend in the short term. The most commonly used indicators in the technical analysis should include:

- Moving Averages;

- William's Volumes;

- Alligator;

- Stochastic;

- MACD — Moving Average Convergence/Divergence;

- Bollinger bands.

Breakouts & reversals

Breakthrough trading is one of the most exciting trading strategies for both novice traders and professionals. There are two types of reliable breakouts that are most effective for Online Trading:

Also, a trader trading in breakouts should keep in mind the period during which he trades, since a smaller time scale will show a larger number of potential breakouts and a greater number of false breaks. Also, the trader should keep in mind that the profit potential will be different for different currency pairs and different periods — a larger period implies a higher profit potential, but on the other hand, a higher possible loss if the breakthrough turns out to be false.

- Breakthroughs of graphic models. Breakouts of the model are the most common form of breakouts since they are based on net price action and breakthroughs of reversal/consolidation models. The most common models include triangles, channels, wedges, pennants, flags, and the less common — head and shoulders.

- Impulse breakouts of higher highs or lower lows. Impulsive breakouts occur when the price breaks above the high or below the low of the recent short-term price range.

Also, a trader trading in breakouts should keep in mind the period during which he trades, since a smaller time scale will show a larger number of potential breakouts and a greater number of false breaks. Also, the trader should keep in mind that the profit potential will be different for different currency pairs and different periods — a larger period implies a higher profit potential, but on the other hand, a higher possible loss if the breakthrough turns out to be false.

How many trades do I place in time?

Each Indian trader can place the number of transactions that the trader considers necessary. The platform does not limit your actions. But it is important to understand that you will not be able to qualitatively control all areas, so the risks in this case increase. However, the user can download, connect and configure a robot that will make trading automated and around the clock. The program can analyze available assets, offer the most profitable and close deals with millisecond accuracy.

Can I sell it before the time expires?

Early expiration occurs when the holder of the Call or Put option decides to exercise his rights defined in the contract before the expiration of his appeal. As a result, the option seller will be required to enforce the rights of an option holder, and the shares will change the owner. This option is optimal if you decide that the asset has already brought you maximum profit.