XM Group Review 2021

Content on this page is intended for information and educational purposes only and should not be considered as an investment advice or investment recommendation.

September 3, 2021

»

»

Updated: 10 / 10 / 21

10 min read

XM BROKER REVIEW

Content on this page is intended for information and educational purposes only and should not be considered as an investment advice or investment recommendation.

Risk disclaimer (more information)

XM's Background

Pros and Cons

Account Types

Demo Account

Deposit and Withdrawal

XM trading platform review

Mobile trading XM

Desktop XM platform review

Markets and products

Research tools and assets

XM Customer care

Education material

Is XM broker reliable?

Accepted Countries

Review methodology

Overall verdict

Alternatives to XM

Frequently Asked Questions

Pros and Cons

Account Types

Demo Account

Deposit and Withdrawal

XM trading platform review

Mobile trading XM

Desktop XM platform review

Markets and products

Research tools and assets

XM Customer care

Education material

Is XM broker reliable?

Accepted Countries

Review methodology

Overall verdict

Alternatives to XM

Frequently Asked Questions

Since its start in 2009, XM has not only been a well-regulated ECN and STP broker, but also a broker with a long history of delivering outstanding online trading services. We'll go through the broker's mechanics, key pros, and downsides in this evaluation of broker XM.

XM's Background

Since 2009, the XM Group (XM com), according to financial markets XM broker reviews, has provided complicated brokerage services in international field. During this period, the firm has expanded its presence to 200 countries, with about 3.5 million traders as clients globally. The firm is concentrating on technical advancement while taking into account the unique characteristics of each location.

Flexible trading conditions for traders of all levels of expertise are the key to XM Group's success. There are cent accounts for learning to trade, traditional accounts for over-the-counter CFD trading, and separate accounts for stock investing. The firm serves as a sub-broker, allowing investors access to global stock markets.

Flexible trading conditions for traders of all levels of expertise are the key to XM Group's success. There are cent accounts for learning to trade, traditional accounts for over-the-counter CFD trading, and separate accounts for stock investing. The firm serves as a sub-broker, allowing investors access to global stock markets.

Pros and Cons

- Order execution is guaranteed to be instantaneous and error-free. 99.35% of orders are processed in less than 200 milliseconds.

- There are non-standard commodity trade assets, such as cocoa and beans. A separate account with access to stock exchanges is available for stock trading.

- Compensation for payment system withdrawal fee.

- Trading terms that are transparent, with a modest entry threshold and moderate leverage.

- Tools for passive trading are presented only by a third-party signal copying service MQL.

- The broker works on the STP-model. Only large investors' trades are displayed on ECN-platforms, small trades form a pool sent to the liquidity provider.

Account Types broker XM review

Create an account on the broker's website to get started with the XM Group. You will discover a link here, and by registering.

Open a genuine trading account with XM Group to begin making money.

XM offers four primary accounts, each with its own set of trading circumstances, with the goal of giving traders with a dynamic trading experience and atmosphere, as well as the best pricing schedule:

The XM Micro Account has the following features:

Register Micro Account

- USD, EUR, GBP, JPY, CHF, AUD, HUG, PLN, RUB, SGD, and ZAR as base currencies.

- The contract size is 1,000 lots.

- Spreads start at 1 pip and go up from there.

- While using MT4, the minimum trading volume is 0.01 lots, and when using MT5, the minimum trade volume is 0.1 lots, with a lot restriction of 100 lots per ticket.

Register Micro Account

The XM Standard Account includes the following features:

Register Standard Account

- USD, EUR, GBP, JPY, CHF, AUD, HUG, PLN, RUB, SGD, and ZAR as base currencies.

- The contract size is 1,000 lots.

- Spreads start at 1 pip and go up from there.

- The minimum trade volume is 0.01 lots, with a limit of 50 lots per ticket.

Register Standard Account

The XM Ultra-Low Account includes the following features:

Ultra-Low Account

- EUR, USD, GBP, AUD, ZAR, and SGD are among the base currencies.

- Contract sizes are based on a regular ultra of 100,000 lots and a micro ultra of 1,000 lots.

- Spreads as low as 0.6 pips are available.

- Lots a restriction per ticket of 50 lots on standard ultra and 100 lots on micro ultra, and a minimum trading volume of 0.01 lots on standard Ultra and 0.1 lots on micro ultra.

Ultra-Low Account

The following are some of the features of the XM Shares Account:

Open Shares Account

- A $10,000 minimum deposit is required.

- This account's basic currency is only USD.

- 1 share is the contract size.

- This account does not offer any leverage.

- The spread is determined by and in accordance with the underlying exchange.

- Depending on the underlying exchange and the individual share, commission costs on this account range from US Dollar 1 to US Dollar 9.

- The number of open and/or pending orders per client is limited to 50.

- The account's minimum transaction volume is one lot, and the lot restriction per ticket is determined by each individual share.

- On this account, no hedging is permitted.

Open Shares Account

The XM Micro Account has the following features:

Register Micro Account

- USD, EUR, GBP, JPY, CHF, AUD, HUG, PLN, RUB, SGD, and ZAR as base currencies.

- The contract size is 1,000 lots.

- Spreads start at 1 pip and go up from there.

- While using MT4, the minimum trading volume is 0.01 lots, and when using MT5, the minimum trade volume is 0.1 lots, with a lot restriction of 100 lots per ticket.

Register Micro Account

The XM Standard Account includes the following features:

Register Standard Account

- USD, EUR, GBP, JPY, CHF, AUD, HUG, PLN, RUB, SGD, and ZAR as base currencies.

- The contract size is 1,000 lots.

- Spreads start at 1 pip and go up from there.

- The minimum trade volume is 0.01 lots, with a limit of 50 lots per ticket.

Register Standard Account

The XM Ultra-Low Account includes the following features:

Ultra-Low Account

- EUR, USD, GBP, AUD, ZAR, and SGD are among the base currencies.

- Contract sizes are based on a regular ultra of 100,000 lots and a micro ultra of 1,000 lots.

- Spreads as low as 0.6 pips are available.

- Lots a restriction per ticket of 50 lots on standard ultra and 100 lots on micro ultra, and a minimum trading volume of 0.01 lots on standard Ultra and 0.1 lots on micro ultra.

Ultra-Low Account

The following are some of the features of the XM Shares Account:

Open Shares Account

- A $10,000 minimum deposit is required.

- This account's basic currency is only USD.

- 1 share is the contract size.

- This account does not offer any leverage.

- The spread is determined by and in accordance with the underlying exchange.

- Depending on the underlying exchange and the individual share, commission costs on this account range from US Dollar 1 to US Dollar 9.

- The number of open and/or pending orders per client is limited to 50.

- The account's minimum transaction volume is one lot, and the lot restriction per ticket is determined by each individual share.

- On this account, no hedging is permitted.

Open Shares Account

These live accounts XM reviews provide traders with not just trading terms that are customized to and matched with their specific trading goals, objectives, and trading styles, but also a dynamic and one-of-a-kind trading environment and trading experience.

Demo Account XM trading review

XM also offers to traders the option of creating a Demo Account, which may be used for a variety of purposes, including but not limited to:

- A practice account for novice traders who want to develop their trading abilities and user experience of using virtual funds in a risk-free environment.

- Traders who are assessing and comparing XM forex broker review and would want to test their trading methods in a simulated live trading environment without losing their cash, as well as traders who want to evaluate and compare brokers in a risk-free environment.

Signing up for a trial account with XM is completely digital and hassle-free. It just takes a few minutes, and demo trading may begin as soon as the trader has registered.

Islamic Account

The aim of an Islamic Account is to serve Muslim traders who rigorously adhere to Sharia law, which prohibits its adherents from paying any interest, such as overnight fees, which is considered wasteful or exploitative.

Islamic Account

The aim of an Islamic Account is to serve Muslim traders who rigorously adhere to Sharia law, which prohibits its adherents from paying any interest, such as overnight fees, which is considered wasteful or exploitative.

Traders who keep positions open for longer than the trading day are charged overnight costs, and this account allows traders to avoid such fees and interest if they keep positions open for longer.

XM trading broker provides Muslim traders the option of opening an Islamic Account on any of the live trading accounts available, with no increase in spreads, extra commissions, or administrative costs on specific financial instruments.

Traders have access to a trading environment that is competitive and cost-effective in terms of trading and non-trading costs thanks to the variety given by these accounts.

Regardless of their degree of talent, education, or experience, XM traders are provided with the advantage they require to facilitate their trading operations.

XM trading broker provides Muslim traders the option of opening an Islamic Account on any of the live trading accounts available, with no increase in spreads, extra commissions, or administrative costs on specific financial instruments.

Traders have access to a trading environment that is competitive and cost-effective in terms of trading and non-trading costs thanks to the variety given by these accounts.

Regardless of their degree of talent, education, or experience, XM traders are provided with the advantage they require to facilitate their trading operations.

XM Deposit and XM withdrawal review

Deposits and withdrawals can be made using a variety of methods, including numerous credit cards, electronic payment methods, bank wire transfer, local bank transfer, and other means.

You may log in to Members Area as soon as you establish a trading account, choose your preferred payment method on the Deposits/Withdrawal pages, and follow the instructions.

You can deposit money in any currency, and it will be instantly converted to your account's base currency using XM's current interbank rate.

For various payment methods offered in all countries, the minimum deposit/withdrawal amount is 5 USD (or similar denomination). The amount, however, changes depending on the payment method you select and the state of your trading account's certification.

Let's look closer at XM broker withdrawal review.

You may log in to Members Area as soon as you establish a trading account, choose your preferred payment method on the Deposits/Withdrawal pages, and follow the instructions.

You can deposit money in any currency, and it will be instantly converted to your account's base currency using XM's current interbank rate.

For various payment methods offered in all countries, the minimum deposit/withdrawal amount is 5 USD (or similar denomination). The amount, however, changes depending on the payment method you select and the state of your trading account's certification.

Let's look closer at XM broker withdrawal review.

What is the priority withdrawal procedure?

To protect all parties from fraud and to reduce the potential of money laundering and/or terrorist funding, XM will only execute withdrawal/refunds back to the original deposit source in accordance with the Withdrawal Priority Procedure outlined below:

Withdrawals from credit/debit cardsWithdrawal requests, regardless of withdrawal method, will be handled through this channel up to the entire amount deposited using this method.

Withdrawals from credit/debit cardsWithdrawal requests, regardless of withdrawal method, will be handled through this channel up to the entire amount deposited using this method. Withdrawals from e-walletsOnce all credit/debit card deposits have been fully reimbursed, e-wallet refunds/withdrawals will be handled.

Withdrawals from e-walletsOnce all credit/debit card deposits have been fully reimbursed, e-wallet refunds/withdrawals will be handled. Other withdrawal optionsOnce the deposits made using the first two ways have been depleted, all additional methods, such as bank wire withdrawals, must be used.

Other withdrawal optionsOnce the deposits made using the first two ways have been depleted, all additional methods, such as bank wire withdrawals, must be used.

Your trading account must be verified before you can withdraw cash. This implies you must first upload your papers to Members Area: Proof of Identity (ID, passport, driving licence) and Proof of Residency (utility bill, telephone/Internet/TV bill, or bank statement), all of which must include your address and name and be no more than 6 months old.

After receiving confirmation from the validation department that your account has been verified, you can request a withdrawal of money by signing in to the Members Area, selecting the Withdrawal tab, and sending a withdrawal request to the broker administration. Your withdrawal can only be sent back to the original source of deposit. On business days, the back office processes all withdrawals within 24 hours.

After receiving confirmation from the validation department that your account has been verified, you can request a withdrawal of money by signing in to the Members Area, selecting the Withdrawal tab, and sending a withdrawal request to the broker administration. Your withdrawal can only be sent back to the original source of deposit. On business days, the back office processes all withdrawals within 24 hours.

XM trading platform review

MetaTrader platforms XM broker reviews claim that XM is one of the few brokers that provides both versions.

Web trading is directly accessible from a single account and is available in a variety of variants. All platforms are connected with a complete site of technical analysis, indicators, and comprehensive tools, as well as stop or tail orders. As a result, you may access XM trading simply by using a browser and logging in to Web Trading.

Web trading is directly accessible from a single account and is available in a variety of variants. All platforms are connected with a complete site of technical analysis, indicators, and comprehensive tools, as well as stop or tail orders. As a result, you may access XM trading simply by using a browser and logging in to Web Trading.

MetaTrader 4, often known as MT4, is the world's most popular trading platform and has been in use in financial markets since 2005. The MetaTrader 4 programme provides a feature-rich, user-friendly interface and a highly customizable trading environment, all of which are designed to meet all of your trading demands and improve your trading success. Charting capabilities and comprehensive order management tools ensure that you can monitor your holdings quickly and affordably.

You should know that the MetaTrader 4 (MT4) trading platform was designed primarily for online Forex trading, but you may also trade other forms of financial assets via CFDs and Spread Betting. Stocks, Indices, Commodities, ETFs, and Futures cannot be traded on any MetaTrader 4 (MT4) platform unless they are CFD contracts or Spread bets. Because you are speculating on price fluctuations with XM, you will not own any underlying assets with CFDs or Spread bets.

Open MT4

You should know that the MetaTrader 4 (MT4) trading platform was designed primarily for online Forex trading, but you may also trade other forms of financial assets via CFDs and Spread Betting. Stocks, Indices, Commodities, ETFs, and Futures cannot be traded on any MetaTrader 4 (MT4) platform unless they are CFD contracts or Spread bets. Because you are speculating on price fluctuations with XM, you will not own any underlying assets with CFDs or Spread bets.

Open MT4

MetaTrader 5, abbreviated as MT5, is a multi-asset trading platform that offers a variety of trading capabilities and financial research tools. MT5 also supports the use of automated trading systems (trading robots) and copy trading. Additional periods and advanced charting tools, for example, can provide you a competitive advantage in the financial markets.

MetaTrader 5 was launched in 2010 as an upgrade to MetaTrader 4.

Open MT5

MetaTrader 5 was launched in 2010 as an upgrade to MetaTrader 4.

Open MT5

MetaTrader 4, often known as MT4, is the world's most popular trading platform and has been in use in financial markets since 2005. The MetaTrader 4 programme provides a feature-rich, user-friendly interface and a highly customizable trading environment, all of which are designed to meet all of your trading demands and improve your trading success. Charting capabilities and comprehensive order management tools ensure that you can monitor your holdings quickly and affordably.

You should know that the MetaTrader 4 (MT4) trading platform was designed primarily for online Forex trading, but you may also trade other forms of financial assets via CFDs and Spread Betting. Stocks, Indices, Commodities, ETFs, and Futures cannot be traded on any MetaTrader 4 (MT4) platform unless they are CFD contracts or Spread bets. Because you are speculating on price fluctuations with XM, you will not own any underlying assets with CFDs or Spread bets.

Open MT4

You should know that the MetaTrader 4 (MT4) trading platform was designed primarily for online Forex trading, but you may also trade other forms of financial assets via CFDs and Spread Betting. Stocks, Indices, Commodities, ETFs, and Futures cannot be traded on any MetaTrader 4 (MT4) platform unless they are CFD contracts or Spread bets. Because you are speculating on price fluctuations with XM, you will not own any underlying assets with CFDs or Spread bets.

Open MT4

MetaTrader 5, abbreviated as MT5, is a multi-asset trading platform that offers a variety of trading capabilities and financial research tools. MT5 also supports the use of automated trading systems (trading robots) and copy trading. Additional periods and advanced charting tools, for example, can provide you a competitive advantage in the financial markets.

MetaTrader 5 was launched in 2010 as an upgrade to MetaTrader 4.

Open MT5

MetaTrader 5 was launched in 2010 as an upgrade to MetaTrader 4.

Open MT5

MetaTrader 4 was designed especially for trading Forex and CFDs, but MetaTrader 5 allows you to trade Forex, Futures, Stocks, Algorithmic Trading, ETFs, and Indices.

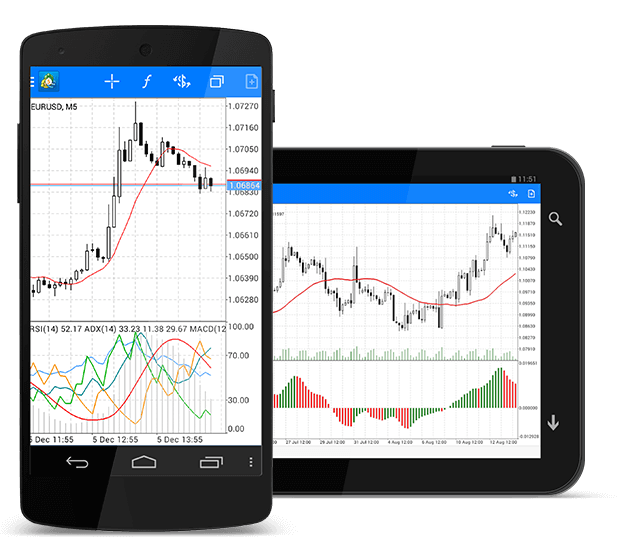

Platforms - Mobile trading XM trader review

MetaTrader 4 provides an excellent mobile trading platform for XM. It is a well-designed, user-friendly platform with an excellent search feature. Touch/Face ID login, on the other hand, is not supported.

Mobile trading platform can be accessed from mobile devices such as tablets and smartphones that run Android or iOS operating systems.

Alternatively, traders can access the trading platforms via their web browser and sign into their XM Demo Account utilizing the trading platforms' WebTrader using their credentials.

You may select from a variety of languages on the mobile trading interface, just like you do on the web trading site. Changing the language on Android devices is a little more difficult because you can only do it if you change your phone's default language.

Mobile trading platform can be accessed from mobile devices such as tablets and smartphones that run Android or iOS operating systems.

Alternatively, traders can access the trading platforms via their web browser and sign into their XM Demo Account utilizing the trading platforms' WebTrader using their credentials.

You may select from a variety of languages on the mobile trading interface, just like you do on the web trading site. Changing the language on Android devices is a little more difficult because you can only do it if you change your phone's default language.

MetaTrader 4 provides an excellent mobile trading platform for XM. It is a well-designed, user-friendly platform with an excellent search feature. Touch/Face ID login, on the other hand, is not supported.

Mobile trading platform can be accessed from mobile devices such as tablets and smartphones that run Android or iOS operating systems.

Alternatively, traders can access the trading platforms via their web browser and sign into their XM Demo Account utilizing the trading platforms' WebTrader using their credentials.

You may select from a variety of languages on the mobile trading interface, just like you do on the web trading site. Changing the language on Android devices is a little more difficult because you can only do it if you change your phone's default language.

Mobile trading platform can be accessed from mobile devices such as tablets and smartphones that run Android or iOS operating systems.

Alternatively, traders can access the trading platforms via their web browser and sign into their XM Demo Account utilizing the trading platforms' WebTrader using their credentials.

You may select from a variety of languages on the mobile trading interface, just like you do on the web trading site. Changing the language on Android devices is a little more difficult because you can only do it if you change your phone's default language.

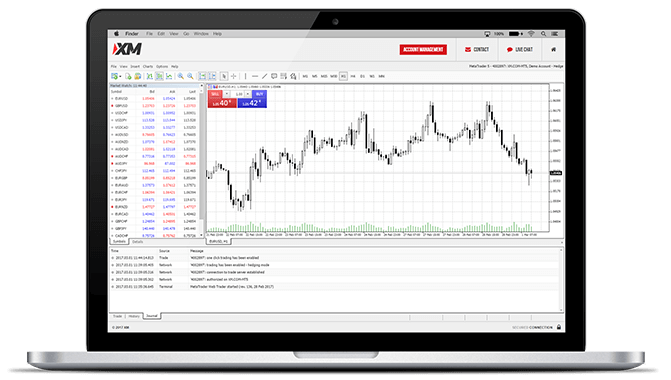

Desktop XM platform review

XM developed the software even more modern and suited among numerous trading platforms that accommodate to any device, including web, mobile, and even multiple account trading. If you choose the Desktop platform or other versions to trade, you will have complete account functionality and will be able to trade with convenience and comfort.

Because XM utilizes MT4 platforms or its latest version MT5, you may use its strong features in conjunction with automated trading or trading robots. EAs with limitless chart use are accessible for individuals who like technical trading, but fantastic manual trading tools will also help you with your approach. As a result, all demands and trading needs are met and at a highly sustainable level.

XM developed the software even more modern and suited among numerous trading platforms that accommodate to any device, including web, mobile, and even multiple account trading. If you choose the Desktop platform or other versions to trade, you will have complete account functionality and will be able to trade with convenience and comfort.

Because XM utilizes MT4 platforms or its latest version MT5, you may use its strong features in conjunction with automated trading or trading robots. EAs with limitless chart use are accessible for individuals who like technical trading, but fantastic manual trading tools will also help you with your approach. As a result, all demands and trading needs are met and at a highly sustainable level.

Because XM utilizes MT4 platforms or its latest version MT5, you may use its strong features in conjunction with automated trading or trading robots. EAs with limitless chart use are accessible for individuals who like technical trading, but fantastic manual trading tools will also help you with your approach. As a result, all demands and trading needs are met and at a highly sustainable level.

Markets and products

Due to regulatory constraints, various companies under the XM Brand provide different trading products. The trading instruments available may differ depending on the Client's country of residency.

XM is very broad with more than 1,000 instruments traded. There should be no shortage of choices here for the trader. As mentioned above, various stocks, commodities, currencies (Forex), precious metals and energy are offered for trading. Especially stock trading is a huge advantage with XM, assets from over 14 different countries are only available.

XM is very broad with more than 1,000 instruments traded. There should be no shortage of choices here for the trader. As mentioned above, various stocks, commodities, currencies (Forex), precious metals and energy are offered for trading. Especially stock trading is a huge advantage with XM, assets from over 14 different countries are only available.

Available markets:

- Currencies

- Stock CFD

- Commodity CFDs

- Indices CFDs

- Precious Metals CFDs

- Energy CFDs

Available markets:

- Currencies

- Stock CFD

- Commodity CFDs

- Indices CFDs

- Precious Metals CFDs

- Energy CFDs

Research tools and assets

Research tools and Market materials are also well organised. News Feed, Technical Summaries, and Technical Analysis are just some of the features that XM has to offer.

Many also appreciate the way XM arranges its market research tools, as you can find everything you need to make wiser trading decisions, including XM Forex broker reviews, Calculators, MQL5 and more, in one location. Subscribers also get access to special technical indicators compatible with both platforms, making automated trading feasible.

XM Customer care

Broker support services are available 24 hours a day, 7 days a week, to assist you with any questions you may have. Weekends and public holidays are excluded.

The following channels are used to communicate with the support service:

The following channels are used to communicate with the support service:

- On the broker's website, there is a chat room. On the XM Group website, you'll also find solutions to the most frequently asked questions.

- E-mail. Each area has its own address list.

- With the use of telephone numbers.

- Through the use of social networking sites (social media).

Contacts and address of XM Group

- Email:support@xm.com

- Phone:+501 223-6696

- Address:No.5 Cork Street, Belize City, Belize, C.A.

Education material

It's necessary to become familiar with XM's trading tools and markets in order to trade efficiently. Make full use of all educational resources. This covers both internal and external edtech tools.

It's a very good thing that XM has such a wide range of instructional materials. Study the financial markets at your own pace. Make sure you take the time to become familiar with your trading platform. Take advantage of worldwide trading hours by making buy and sell trades, and most importantly understand how to reduce and manage investment risk.

It's a very good thing that XM has such a wide range of instructional materials. Study the financial markets at your own pace. Make sure you take the time to become familiar with your trading platform. Take advantage of worldwide trading hours by making buy and sell trades, and most importantly understand how to reduce and manage investment risk.

Trading with XM may be easier if you take an analytical approach.

Observe the XM platforms and teach yourself to think more logically about the markets by looking around. Despite the fact that it is a new skill set for many, the market demands it.

Observe the XM platforms and teach yourself to think more logically about the markets by looking around. Despite the fact that it is a new skill set for many, the market demands it.

Is XM broker reliable?

In addition to the International Financial Services Commission (IFSC), CySEC, ASIC, XM is regulated by the International Securities & Exchange Commission (CySEC), and Australian Securities and Investments Commission (ASIC) (ASIC). Clients' funds are stored in a separate bank account until they are withdrawn from the account. XM uses tier-1 banks for this, for extra security. Financial health and strength of a bank's Tier 1 rating is determined by the official rating.

Because of this, we can confidently say that XM is secure and reliable.

Because of this, we can confidently say that XM is secure and reliable.

Accepted Countries

Thanks to XM's ease of use, nearly anybody may establish a free account. Rarely are there any exceptions, and they tend to be people from nations with uncertain economic or political histories.

There are a lot more countries that XM welcomes traders from such as Australia, Thailand, United Kingdom, South Africa, Singapore. Hong Kong, India, France, Germany, Sweden, Norway, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar.

There are a lot more countries that XM welcomes traders from such as Australia, Thailand, United Kingdom, South Africa, Singapore. Hong Kong, India, France, Germany, Sweden, Norway, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar.

U.S., Canadian, Israeli, Iranian, Portuguese, and Spanish traders cannot utilise XM.

Review methodology

Aside from testing XM, we also gathered secondary information from trustworthy sources, as well as user-generated evaluations during our XM FX review process.

Overall verdict

Finally, with several highly regarded licences under its belt, it is a well-regulated broker with exceptionally customer-friendly terms. Positive balance protection, no requotes and no hidden fees or commissions policy, as well as rigorous real-time market execution policy, make XM a very popular trading platform. This liberal approach to pricing, trading conditions, and overall possibilities makes XM a really human broker by comparison.

Alternatives to XM

The top alternatives to XM include the following dealers:

- CFD and FX broker:

- Forex and CFD broker:

- Australia's leading CFD and FX broker:

Forex and CFD broker:

Forex and CFD broker:

Frequently Asked Questions

- Is XM good for beginners?As we explained above how does XM trading work, a well-regulated and trustworthy broker, XM offers an excellent bonus system and excellent trading facilities for both novices and experienced traders, making it a perfect choice for both.

- How long does it take to withdraw from XM?The back office will handle your withdrawal request within 24 hours. e-wallet payments are received the same day, but bank wire or credit/debit card payments generally take 2 to 5 business days to arrive.

- How much is the minimum deposit in XM?For various payment methods offered in all countries, the minimum deposit/withdrawal amount is 5 USD (or similar denomination). The amount, however, changes depending on the payment method you select and the state of your trading account's certification. In the Members Area, you may learn more about the deposit and withdrawal processes.

- What is the minimum withdrawal on XM?For various payment methods offered in all countries, the minimum deposit/withdrawal amount is 5 USD (or similar denomination). The amount, however, changes depending on the payment method you select and the state of your trading account's certification. In the Members Area, you may learn more about the deposit and withdrawal processes.

- How does XM make money?They earn money by charging you different fees at different activities. Generally, you should keep a look out for the following three sorts of fees:

Trading costs are brokerage fees that you pay when you make a trade. You pay a commission, a spread, or a financing rate. - Does XM allow scalping?Yes.

- Does XM have inactivity fee?XM does charge a fee for inactive accounts.

- What is XM leverage?They provide leverages ranging from 1:1 to 888:1. The leverage is determined by equity.

- Does XM allow copy trading?XM does not provide direct copy or social trading services.

- How does XM credit work?The XM Loyalty Program awards clients XM Points (XMP) for each lot exchanged. These XMP can be redeemed at any moment for a credit boost that can only be used for trade.

- How do I withdraw money from XM account?Following are the procedures to withdraw money from XM:

- Access your account by entering your username and password.

- To withdraw funds, select the relevant option from the drop-down menu.

- Please choose a withdrawal method and/or a destination account (if more than one option is available).

- Specify the amount and, if asked, the reason or description for the withdrawal.

- Your request has been sent.

- Access your account by entering your username and password.

GENERAL RISK WARNING:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

87% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

87% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.