Plus500 Review 2021

Content on this page is intended for information and educational purposes only and should not be considered as an investment advice or investment recommendation.

October 14, 2021

»

»

Updated: 25 / 10 / 21

10 min read

PLUS500 BROKER REVIEW

Content on this page is intended for information and educational purposes only and should not be considered as an investment advice or investment recommendation.

Risk disclaimer (more information)

About Plus500

Pros and Cons

Fees and commissions

Account Types

Deposit and Withdrawal

Plus500 Web trading platform

Plus500 Mobile trading platform

Desktop trading platform

Markets and products

Research tools and assets

Plus500 Customer care

Education material

Accepted countries

Plus500 broker review process methodology

Is Plus500 safe?

Alternatives to Plus500

Overall verdict

Frequently Asked Questions

Pros and Cons

Fees and commissions

Account Types

Deposit and Withdrawal

Plus500 Web trading platform

Plus500 Mobile trading platform

Desktop trading platform

Markets and products

Research tools and assets

Plus500 Customer care

Education material

Accepted countries

Plus500 broker review process methodology

Is Plus500 safe?

Alternatives to Plus500

Overall verdict

Frequently Asked Questions

The first step toward effective exchange trading is selecting the appropriate broker. Many businesses now provide their services on the market, but not all of them are reliable. Let us not forget about each individual trader's preferences: for some, low spreads are more essential, while others would like a more trustworthy business with average rates.

In this post, we will look at the Plus500 broker review, which has established itself as one of the most trustworthy.

In this post, we will look at the Plus500 broker review, which has established itself as one of the most trustworthy.

About Plus500

Additionally, Plus500 is an Australian brokerage firm with its headquarters in Sydney.

Plus500 takes great pride in being one of the most highly rated CFD providers across a wide range of markets. Plus500 is in a good position to ensure future growth as a result of its lucrative foundation.

While maintaining pricing transparency and a focus on innovation in relation to marketing initiatives, Plus500 is committed to providing a cumulative offering to traders with a variety of needs and trading preferences. Plus500 is also committed to expanding its reach in the global trading community by increasing its cumulative offering.

Plus500 takes great pride in being one of the most highly rated CFD providers across a wide range of markets. Plus500 is in a good position to ensure future growth as a result of its lucrative foundation.

While maintaining pricing transparency and a focus on innovation in relation to marketing initiatives, Plus500 is committed to providing a cumulative offering to traders with a variety of needs and trading preferences. Plus500 is also committed to expanding its reach in the global trading community by increasing its cumulative offering.

Pros and Cons

- Large number of trading assets

- Option to choose the site's interface language (the interface is accessible in 31 languages)

- Ability to trade using mobile devices

- Platform that is easy to use and understand

- Trading fees are kept to a minimum

- The website does not provide complete information about the trading conditions

- The broker does not work with traders from Ukraine, the United States, and some other countries

- The broker prohibits scalping, hedging orders, and automated trading

- There is a scarcity of depth in research instruments

- Limited selection of products

Fees and commissions

When selecting a broker, one of the factors to consider is the amount of commission charged. Plus500 offers a cost structure that is easy to understand. One of the most important features to look for is a tight spread of just 0.6 pips for the EUR/USD pair, as well as a diverse selection of trading instruments. Plus500's costs are solely based on fee-free spreads since this kind of charge is the most straightforward to calculate and is the best option for many traders who are not reliant on a specific trading technique.

Further, there is no withdrawal fee and the minimum withdrawal amount is 100$, which is a significant savings. Nonetheless, Plus500 will levy a fee for accounts that are inactive for an extended period of time. This implies that if the account stays dormant for three months and has no transactions, a fee of up to ten dollars will be levied.

Further, there is no withdrawal fee and the minimum withdrawal amount is 100$, which is a significant savings. Nonetheless, Plus500 will levy a fee for accounts that are inactive for an extended period of time. This implies that if the account stays dormant for three months and has no transactions, a fee of up to ten dollars will be levied.

Account types and Account opening

Plus500 only provides one kind of account, which is known to as a Retail account by the industry. If you satisfy two of the following three requirements, you may be eligible to apply for a Professional account:

This implies that you will be able to complete the registration procedure quickly and simply while sitting in front of your device.

- Trading activity has been sufficient in the past 12 months.

- Portfolio of financial instruments valued at more than €500,000

- Relevant work experience in the financial services industry is required.

This implies that you will be able to complete the registration procedure quickly and simply while sitting in front of your device.

An account with an online broker is very similar to a traditional bank account, and the process of opening one is at least partially completed online. Some brokers process your application as quickly as opening a new Gmail account, while others require you to wait a couple of days while they conduct a background check on you. The money in your account will be used to hold your financial assets, such as stocks or foreign exchange positions, as opposed to just your money. A new account can be opened at any time without charge.

Following the completion of the online registration process, you will be required to authenticate your identity and submit evidence of residence. You may submit a copy of your identification card or passport to validate your identity, as well as a bank statement or utility bill to prove your residence in order to complete the process. You may also use a driving licence or a residence permit for ID verification, as well as a toll taxes letter, a pay slip, or an address card to prove your domicile.

Deposit and withdrawal

- Bank transfer

- Visa or MasterCard Credit or debit card

Electronic Wallet

Electronic Wallet PayPal

PayPal- Skrill

In contrast to a bank transfer, which may take several business days, payment with a credit/debit card and electronic wallets is immediate.

Money may only be deposited into your account if the account is in your name.

Money may only be deposited into your account if the account is in your name.

Can anyone tell me how long it takes to get money out of Plus500? In our testing, we discovered that the debit card transfer withdrawal took more than three working days.

You may only make withdrawals from accounts that are in your name.

What is the process for withdrawing money from Plus500?

What is the process for withdrawing money from Plus500?

- Access your account by logging in using your username and password.

- To access the menu, choose the 'Menu' icon in the upper left corner.

- Select 'Withdraw' from the drop-down menu.

- To begin the transaction, choose 'Open a Withdrawal' from the drop-down menu.

- Enter the amount you'd like to withdraw from your account.

Plus500 Web trading platform

Making deals is the most essential part of the trading business. There is a Flash version of the WebTrader Plus500 platform. This implies that in order to trade, you do not need to install any software at all on your computer.

A mobile-optimized version of the site is also available for your convenience. Nothing has to be downloaded and you may use your smartphone or tablet without having to download anything. However, if you so want, you may download and use a mobile trading application on your smartphone.

A mobile-optimized version of the site is also available for your convenience. Nothing has to be downloaded and you may use your smartphone or tablet without having to download anything. However, if you so want, you may download and use a mobile trading application on your smartphone.

Plus500 trading programme is popular among experts as well. A variety of analytical tools will assist consumers in better understanding the trends of the industry. The only thing you'll need to utilise the Plus500 trading programme is your smartphone.

Although it is accessible for no cost, its high quality has already been established by favourable evaluations in shops. As a result, it becomes a significant option on the road to profitability as well. An inactivity fee of ten euros is levied if the account has been inactive for more than three months.

The charge, on the other hand, will only be applied if there is sufficient money in the account. The possibility of a negative balance exists but is not expected. Plus500 customers may trade Bitcoin, allowing them to make significant profits.

In order to minimise the possibility of huge losses, a guaranteed stop loss feature has been included.

Although it is accessible for no cost, its high quality has already been established by favourable evaluations in shops. As a result, it becomes a significant option on the road to profitability as well. An inactivity fee of ten euros is levied if the account has been inactive for more than three months.

The charge, on the other hand, will only be applied if there is sufficient money in the account. The possibility of a negative balance exists but is not expected. Plus500 customers may trade Bitcoin, allowing them to make significant profits.

In order to minimise the possibility of huge losses, a guaranteed stop loss feature has been included.

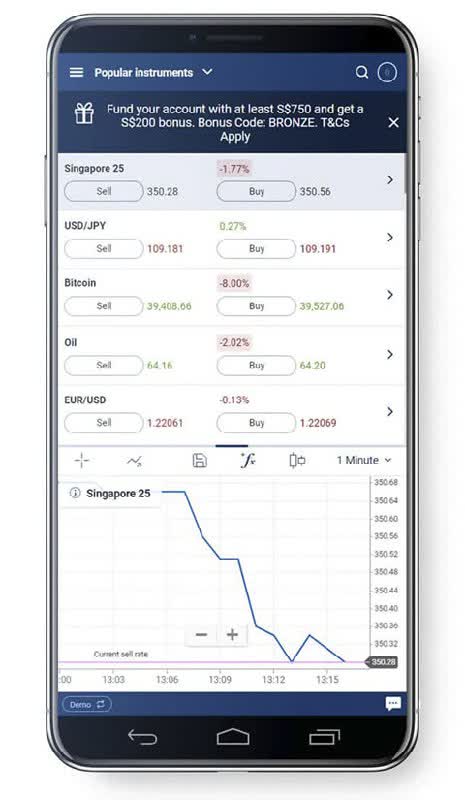

Plus500 Mobile trading platform

The Plus500 mobile platform is quite similar to the Plus500 online platform in terms of functionality. It includes all of the same features and is just as easy to use as its predecessor: the same order types, the same notification options. This is an excellent addition for investor accounts looking to avoid losing money when trading with CFDs because they may be notified of sudden price changes earlier than they would otherwise be aware of.

The mobile application is available for download on iOS, Android, and Windows devices. We tried the mobile iOS software on a normal smartphone, but you may also use a wristwatch, which we did not do. It was fantastic.

Plus500 offers a secure two-step login process, as well as the option of using biometric authentication, which is a handy feature.

The mobile application is available for download on iOS, Android, and Windows devices. We tried the mobile iOS software on a normal smartphone, but you may also use a wristwatch, which we did not do. It was fantastic.

Plus500 offers a secure two-step login process, as well as the option of using biometric authentication, which is a handy feature.

The Plus500 mobile platform is quite similar to the Plus500 online platform in terms of functionality. It includes all of the same features and is just as easy to use as its predecessor: the same order types, the same notification options. This is an excellent addition for investor accounts looking to avoid losing money when trading with CFDs because they may be notified of sudden price changes earlier than they would otherwise be aware of.

The mobile application is available for download on iOS, Android, and Windows devices. We tried the mobile iOS software on a normal smartphone, but you may also use a wristwatch, which we did not do. It was fantastic.

Plus500 offers a secure two-step login process, as well as the option of using biometric authentication, which is a handy feature.

The mobile application is available for download on iOS, Android, and Windows devices. We tried the mobile iOS software on a normal smartphone, but you may also use a wristwatch, which we did not do. It was fantastic.

Plus500 offers a secure two-step login process, as well as the option of using biometric authentication, which is a handy feature.

Desktop trading platform

Plus500 does not provide a desktop trading interface for its customers.

Markets and products

Plus500 provides traders with CFDs on all of the most prominent financial markets, as well as currency. When compared to their rivals, they have a wide variety of markets. Many financial markets are accessible via their low competitive spreads, leverage, and options trading. They do not provide bonding services.

- CFDs on 1,800 stocks

- CFDs on stock indexes (33 contracts)

- CFDs on exchange-traded funds (ETFs) and commodity futures (CFDs)

- 14 CFDs on cryptocurrencies are available.

- 70 different currency pairs are traded on the spot market.

Plus 500 provides leverage on more than 60 of the most popular forex pairings, including the EUR/USD, GBP/USD, and EUR/GBP. CFDs are used for all of the trading in the Forex markets. They provide cutting-edge solutions for preserving your earnings and limiting the possibility of losses.

Cryptocurrencies are being made available.

Cryptocurrencies are being made available.

Yes, you may trade cryptocurrencies on Plus500's trading platform.

Here is a complete list of all of the cryptocurrencies that are currently available:

Here is a complete list of all of the cryptocurrencies that are currently available:

- Bitcoin is a cryptocurrency that is used to transact online (BTC)

- Ethereum is a cryptocurrency that is used to store value (ETH)

- NEM

- Litecoin

- Bitcoin Cash (BCH)

- EOS

- IOTA NEO Cardano (IOTA NEO Cardano) (ADA)

- Spectacular (XLM)

- IOTA NEO Cardano (IOTA NEO Cardano) (ADA)

Plus500 was the first broker to provide Bitcoin contracts for difference (CFDs) in 2013.

Research tools and assets

Neither trade ideas nor fundamental data are available from Plus500.

Charting

The quality of the graphing tool is excellent. There are 119 technical indicators as well as a number of useful editing tools. You may also save the charts that you create.

This is particularly advantageous for customers that need a large number of technical indications. The majority of well-known technical indicators, such as the RSI, MACD, and so on, are accessible.

Charting

The quality of the graphing tool is excellent. There are 119 technical indicators as well as a number of useful editing tools. You may also save the charts that you create.

This is particularly advantageous for customers that need a large number of technical indications. The majority of well-known technical indicators, such as the RSI, MACD, and so on, are accessible.

Feed of recent news

The economic calendar and market analysis produced by Plus500's research staff are both well-designed, however there is no news feed or newsletter.

Short assessments of market events and businesses may be found on this page. Plus500's website has these assessments available for viewing if you head to the Trading section and then to the 'News and Market Insight' section.

The economic calendar was a hit with us. You have the option of filtering for macro events or events that are relevant to your business.

The economic calendar and market analysis produced by Plus500's research staff are both well-designed, however there is no news feed or newsletter.

Short assessments of market events and businesses may be found on this page. Plus500's website has these assessments available for viewing if you head to the Trading section and then to the 'News and Market Insight' section.

The economic calendar was a hit with us. You have the option of filtering for macro events or events that are relevant to your business.

Other research tools that you may find useful

Additionally, the Traders' Sentiment tool at Plus500 may be used, which displays the percentage of buyers and sellers at Plus500 for a particular asset. This is not, however, a feature that may be used for ladder trading purposes. Nonetheless, it may be a helpful piece of information.

A tool called "Live Data" is also available, which displays a few statistics regarding the price of an asset, such as the lowest and highest price within 5 minutes, within 60 minutes, or during a single day.

Additionally, the Traders' Sentiment tool at Plus500 may be used, which displays the percentage of buyers and sellers at Plus500 for a particular asset. This is not, however, a feature that may be used for ladder trading purposes. Nonetheless, it may be a helpful piece of information.

A tool called "Live Data" is also available, which displays a few statistics regarding the price of an asset, such as the lowest and highest price within 5 minutes, within 60 minutes, or during a single day.

Plus500 Customer care

Their customer service receives overwhelmingly favourable reviews from traders who use their platform. The Plus 500 platform offers live online chat customer service as well as e-mail customer service, with professionals accessible around the clock. Customer support services answers were relevant and educated, and the live chat is responsive and fast to respond.

Users have claimed that e-mail replies may take up to an hour, but response times can vary depending on the intricacy of the problem being investigated. Traders have expressed satisfaction with this broker's transparency in revealing their rates and fees.

However, according to investopedia.com, when Plus500 was contacted via email and asked about the average spread on the EUR/USD and USD/JPY pairs, the company responded in an unusual manner. They did not provide a specific number, instead providing an open-ended response.

Users have claimed that e-mail replies may take up to an hour, but response times can vary depending on the intricacy of the problem being investigated. Traders have expressed satisfaction with this broker's transparency in revealing their rates and fees.

However, according to investopedia.com, when Plus500 was contacted via email and asked about the average spread on the EUR/USD and USD/JPY pairs, the company responded in an unusual manner. They did not provide a specific number, instead providing an open-ended response.

They do not provide customer assistance over the phone.

Education material

Education and training are not of the highest quality. TradeStation offers a demo account for traders who want to get a feel for the platform before putting their own money on the line. Experimenting with a demo account is a fantastic way for novices to learn the ropes and get valuable experience. Plus500 does supply its customers with the KID document (also known as the "Key Information Document"). The KID document explains the instrument information and risks involved with trading commodities, ETFs, forex, indexes, options, equities, or cryptocurrencies, as well as other financial instruments.

Their website has a section titled "Trader's Guide," which contains short videos:

Their website has a section titled "Trader's Guide," which contains short videos:

Slippage when opening a position

How to trade?

Popular strategies

What is a Rollover?

What are options?

These films serve as demonstrations of how the platform is used. These instructional tools are not intended for traders who want to improve the performance and outcomes of their portfolios via the use of technical analysis.

Plus500 has a section devoted to risk management. It goes through each of the many kinds of conditional orders that are available and how they may assist traders in reducing risk.

Plus500 has a section devoted to risk management. It goes through each of the many kinds of conditional orders that are available and how they may assist traders in reducing risk.

Is Plus500 Safe?

What makes Plus500 so secure is as follows:

Plus500 is a legitimate company that is regulated by the most stringent financial regulators. Plus500 is regulated by some of the world's most prestigious financial authorities

Plus500 is a legitimate company that is regulated by the most stringent financial regulators. Plus500 is regulated by some of the world's most prestigious financial authorities

The Monetary Authority of Singapore(MAS)

The Monetary Authority of Singapore(MAS) the Financial Conduct Authority of the United Kingdom(FCA)

the Financial Conduct Authority of the United Kingdom(FCA) The Australian Securities and Investment Commission are examples of such organisations(ASIC)

The Australian Securities and Investment Commission are examples of such organisations(ASIC)

The Monetary Authority of Singapore(MAS)

The Monetary Authority of Singapore(MAS) the Financial Conduct Authority of the United Kingdom(FCA)

the Financial Conduct Authority of the United Kingdom(FCA) The Australian Securities and Investment Commission are examples of such organisations(ASIC)

The Australian Securities and Investment Commission are examples of such organisations(ASIC)

As a result, it is considered a safe broker (low-risk).

Plus500 is a legitimate company that is regulated by the most stringent financial regulators. Plus500 is regulated by some of the world's most prestigious financial authorities

Plus500 is a legitimate company that is regulated by the most stringent financial regulators. Plus500 is regulated by some of the world's most prestigious financial authorities

Plus500CY Ltd. is licenced and regulated by the Cyprus Securities and Exchange Commission (#250/14).

It is a publicly traded business that is traded on the London Stock Exchange (LSE: PLUS) and is a component of the FTSE 250 Index.

According to the Financial Services Compensation Scheme (FSCS), traders are covered (FSCS)

There is a public offering of shares on the London Stock Exchange. This significantly improves the openness of the business's activities, as well as the solvency and liquidity of the organisation. This is critical in order to safeguard the money it holds on behalf of its investors.

It is a publicly traded business that is traded on the London Stock Exchange (LSE: PLUS) and is a component of the FTSE 250 Index.

According to the Financial Services Compensation Scheme (FSCS), traders are covered (FSCS)

There is a public offering of shares on the London Stock Exchange. This significantly improves the openness of the business's activities, as well as the solvency and liquidity of the organisation. This is critical in order to safeguard the money it holds on behalf of its investors.

The business is governed by top-tier regulatory bodies throughout the globe. Risk is reduced as a result of the fact that these regulatory organisations encourage openness and a particular level of dependability in the company's operations.

Accepted Countries

Plus500 accepts trades from customers in more than 60 countries and in 32 different languages.

Plus500 broker review process methodology

As a result of our efforts, we want to assist you in finding the best online brokers by making the process more transparent. Each and every item on Top-trading-app is based on trustworthy facts and impartial information. As a result of our more than a decade of financial expertise, coupled with reader input, we are pleased to demonstrate how the basis of your Top-trading-app experience is laid out. Every time we assess a broker service, we update our approach and fine-tune all of our criteria in order to be able to evaluate it properly.

Overall verdict

Plus500 is a reputable CFD brokerage. It is suggested for traders who understand the dangers associated with CFD trading. The broker is regulated by a number of financial regulators across the world, including the Financial Conduct Authority of the United Kingdom, and is publicly traded on the London Stock Exchange. For those who do not reside in the United Kingdom, other regulators such as Plus500 Cyprus will most likely be of use. For example, in this situation, you would be covered under the Cypriot investor protection law.

Attention Daytraders: Please Read! "A trading technique based on the idea that customer transactions are started and completed within a two-minute time limit in order to collect fast gains from minor price fluctuations," according to the Plus500 definition. If Plus500 suspects that you are scalping, your account may be banned and your account may be canceled. As a result, if you want to make a large number of transactions within 2 minutes, Plus500 is not the broker for you.

The Plus500 platform is simple to use, and it provides an excellent user experience even for those who are new to it. The account opening process and customer service are both smooth.

Attention Daytraders: Please Read! "A trading technique based on the idea that customer transactions are started and completed within a two-minute time limit in order to collect fast gains from minor price fluctuations," according to the Plus500 definition. If Plus500 suspects that you are scalping, your account may be banned and your account may be canceled. As a result, if you want to make a large number of transactions within 2 minutes, Plus500 is not the broker for you.

The Plus500 platform is simple to use, and it provides an excellent user experience even for those who are new to it. The account opening process and customer service are both smooth.

CFDs, on the other hand, are the only product available, and the research tools are restricted, as are the CFD fees, which are standard.

You should feel free to give Plus500 a try since the minimum deposit requirement is minimal, there is no withdrawal charge for withdrawals above $100, and the inactivity fee only kicks in after three months of inactivity. Just be careful not to risk all of your money while trading CFDs with this - or any - provider, since it is very simple to lose money when trading CFDs. When dealing with CFDs, there is always a significant danger of losing your money. Use caution!

You should feel free to give Plus500 a try since the minimum deposit requirement is minimal, there is no withdrawal charge for withdrawals above $100, and the inactivity fee only kicks in after three months of inactivity. Just be careful not to risk all of your money while trading CFDs with this - or any - provider, since it is very simple to lose money when trading CFDs. When dealing with CFDs, there is always a significant danger of losing your money. Use caution!

Alternatives to Plus500

If you believe that any of the above Plus500 options are not quite what you are searching for, or if you would just want to see some alternatives, please let us know. Consider the alternatives to Plus500 listed below, each of which has received excellent ratings.

Frequently Asked Questions

- Is Plus500 any good?The reputation of Plus500 is excellent, and it is recommended to trade with Plus500. Plus500 is utilized by more than 15,500 active traders and Plus500 members worldwide. CFD trading is available at Plus500. Plus500 requires a 100 - dollar investment as a starting point.

- Is Plus500 good for beginners?Plus500 for beginners is often regarded as the finest option for traders just getting started in the trading world. A demo account may be used as a beginning point, allowing a novice to practice and develop their abilities in trading different financial products and performing technical analysis on a virtual account.

- Is Plus500 rigged?Plus500 is a regulated and well-established company that has been in operation for more than 13 years. Plus500 is definitely not a scam.

- Does Plus500 have a demo account?Plus500 provides a risk-free demo account.

- How long does it take to withdraw from Plus500?Withdrawal processing from Plus500 takes between 2 and 5 days, depending on the amount being requested.

- Is FXTM regulated in India?Yes, FXTM is regulated in India.

- Is Plus500 legitimate?In 2008, Israel-based Plus500 was established. For more than 13 years, Plus500 has facilitated financial market trading. Plus500 provides customers with the opportunity to trade contract for difference (CFD) contracts. To ensure the security of your money, Plus500 keeps all deposits in separate tier 1 bank accounts. Plus500 is regulated by Plus500UK Ltd, which is licensed and regulated by the FCA (#509909), Plus500CY Ltd, which is licensed and regulated by CySEC (#250/14), Plus500AU Pty Ltd (ACN 153301681), ASIC in Australia (AFSL #417727), FMA in New Zealand (FSP #486026), and Authorised Financial Services Provider in South Africa (FSP #47546), and thus can be considered legitimate.

- What is the minimum deposit for Plus500?The minimum deposit required to trade with Plus500 is one hundred dollars.

- Is Plus500 legal in India?Plus500 is a legitimate and secure internet broker in India.. It is an excellent online broker for individuals who wish to trade CFDs on a straightforward trading interface with little learning curve. Plus500 is a trading platform that we can suggest to both new and experienced traders.

- How does Plus500 make money?Plus500 applies a spread to more than 2,000 different assets. As a market maker, this broker makes money off of the losses of his clients.

- What is better than Plus500?You should choose a broker relying on your need and requirements as a trader. Plus500 definitely fits a huge amount of brokers. And of course you have to look for your broker.

- How can I earn fast money by Plus500?Getting started on Plus500 is as simple as establishing buy or sell positions on various instruments. Invest in a purchase (long) position if you believe the asset's price will rise, and in a sell (short) position if you believe the asset's price will fall. Trading involves risk, and in order to make these transactions, you must have understanding of the market. Plus500 provides a demo account that may be used to practice trading before you start with real money.

GENERAL RISK WARNING:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

87% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

87% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.